2018 at 1139 pm. At the current share price of Rs 153395 this results in a dividend yield of 202.

How To Save Capital Gains Tax On Property Sale Capital Gain Capital Gains Tax Tax

Hope the above helps.

. Axis Bank Hikes Fd Interest Rate Earn Up To 6 On This Tenure Fund Houses Bet Big On Auto Auto Ancillary Vehicle Finance Agri Fin An Indian Faang Lessons From Jeff Bezos. EPF Dividend Rate. Applicability of Tax Audit TDS clauses under Form 3CD and its in depth analysis alongwith rate chart of TDS are covered in this article.

Ordinary meaning of dividend is a share of profits whether at a fixed rate or otherwise allocated to holders of shares in a company. Qualification Disqualification of Auditors under Companies Act 2013. For the year ending March 2022 Infosys has declared an equity dividend of 62000 amounting to Rs 31 per share.

At the current share price of. EMPLOYEES PROVIDENT FUND BOARD EPF. The tax rates displayed are marginal and do not account for deductions exemptions or rebates.

The Government of India in Budget 2018 brought down the contribution of the women employees to 8 during the first 3 years of their employment as against 12 or 10 depending upon the. Premature withdrawal from EPF. Dividend Rs See More.

DOWNLOAD 891 RELIEF CALCULATOR FREE FY. You pay a maximum of 2280 RON as CASS contribution in 2018 if you earn over RON 22800 for the whole year 10 income tax. For the year ending March 2022 Graphite India has declared an equity dividend of 50000 amounting to Rs 10 per share.

Personal Finance EPF Guide MC Minis Big Shark Portfolios. PART II THE BOARD AND THE INVESTMENT PANEL. Premature withdrawal from EPF.

- 14th August 2018. Per Annum Simpanan Shariah. Salary for January 2018.

The lower dividend rate between Simpanan Konvensional and Simpanan Shariah for each respective year with an additional one 1 percent. Dividend can be paid on Equity or. As an employee working in a corporate set-up there are several things one would like to know about the Employees Provident Fund EPF.

For the year ending March 2022 Hindustan Zinc has declared an equity dividend of 90000 amounting to Rs 18 per share. This should result in tangible and distributable income for dividend payments to EPF members. EPF BOARD 11 Apr 2022.

The last rate that you opt for will be your new contribution rate and will. Best ETF funds holds assets such as stocks commodities bonds and trades. Because theres a matching incentive of 15 up to RM250 per year for EPF i-Saraan contribution from the year 2018 until the year 2022.

Employers EPF contribution rate Employees EPF contribution rate Monthly salary rate RM5000 and below More than RM5000 RM5000 and below More than RM5000 Malaysian age 60 and above 4 0 Malaysian below age 60 13 12 9 Permanent resident below age 60 13 12 9 Permanent resident age 60 and above 65 6 55. TDS Rate Chart for FY 2022-2023 AY 2023-2024 including budget 2022 highlights. Normal Slab Rate 10.

Bharat Bandh Sbi Q1 Results Epf Nifty Crash Lic. Get latest NAV Returns SIP Returns Performance Ranks Dividends Portfolio CRISIL Rank Expert Recommendations and Comparison with gold stockULIP etc. 515 Rs51500 per share515Dividend.

S benchmark repo rate at least 50 basis points higher from the current 540One basis point is 001. UOAREIT share price UOAREIT quarter report UOAREIT financial report UOAREIT dividend UOAREIT dividend history. However softening food and fuel prices and challenges to growth will likely ensure that the repo rate does not touch the August 2018 peak of 650.

For all your contributions the government guarantees a minimum paid dividend rate of 250 for Simpanan Konvensional. Dividend taxes Lowest marginal rate. The following is an example of Annual Dividend calculation based on Aggregate.

As a relief to investors if you were already holding your. A Mutual Fund specified under clause 23D of section 10 where the amount is payable to it as interest or dividend in respect of any sharessecurities owned by it or in which the specified mutual funds. Disposal - Off Market.

Sign In Register Free Home. Tengku Zafrul has highlighted that the EPF did not liquidate any specific asset to fund the Covid-19-related withdrawal schemes. The dividend rate for EPF Self Contribution is the same as the yearly EPF dividend rate announced by EPF.

As per Section 235 of Companies Act 2013 defines the term as including any interim dividend. Employee Provident Fund or EPF is a scheme that provides retirement benefits to salaried employees in private sector companies with more than 20 employees. May choose to contribute more than the stipulated rates under the Third Schedule to the EPF Act 1991.

Dividend is basically the share of profit distributed among shareholders. CONVERT FIGURES IN TO WORD EXCEL ADD IN INDIAN RUPEE. For the purposes of managing the Fund and for carrying into effect the purposes of this Act a body corporate by the name of Employees Provident Fund Board is established with perpetual succession and a common seal and which may sue and be sued in its corporate name and.

Starting from April 1 2018 sale of shares and equity-oriented mutual funds held for one year or more will attract long-term capital gains tax at a flat rate of 10 per cent plus cess at 4 per cent without the benefit of indexationThis change in tax rules was proposed in Budget 2018 and enacted thereafter. The scheme is managed under the aegis of Employees Provident Fund Organisation EPFO. By the end of 2018 Astro customers will be able to watch football.

As per provisions of section 1233 which deals with payment of Interim Dividend it states that The Board of Directors of a company may declare interim dividend during any financial year or at any time during the period from closure of financial year till holding of the. Announcement Date Ex-Bonus Ratio. For taxation purposes Capital assets are divided into two categories- Equity-oriented Investments and other than Equity investmentsThis can be further categorized as Short Term Capital Gain and Long Term Capital Gain.

EPF is the main scheme under the Employees Provident Funds and Miscellaneous Provisions Act 1952. P V VISWANATHAN says. 61 Gains on Equity-oriented Mutual Funds held for a year or more are.

Establishment of the Board. Dear sir I need. The effective rate is usually lower than the marginal rate.

The Self Contribution is updated to which EPF account. Barclays India economist Rahul Bajoria said the MPC minutes showed that front-loaded rate hikes and. COMPUTATION OF INCOME TAXABLE AT SPECIAL RATE.

Exchange-traded fund ETF is an investment fund traded on stock exchanges. At the current share price of. Check your performance of ETFs.

26 Jan 2018 0628 PM Post 4. Section 123 of the Companies Act 2013 deals with the declaration and payment of dividend.

Epf Declares Dividend Of 6 10 For 2021 Above Pre Pandemic 2019 The Edge Markets

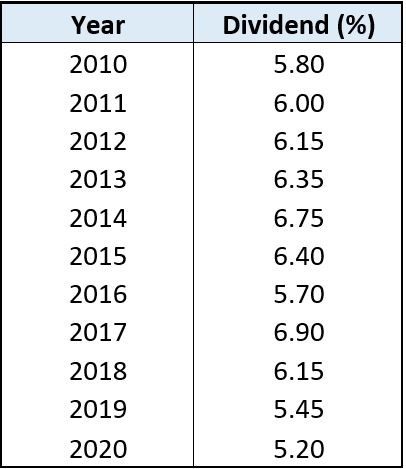

Epf Kwsp Dividend Rates 2019 Otosection

2 Statistical Summary Of Epf Return On Investment And Dividend Rate Download Table

Epf In A Low Interest Rate Environment

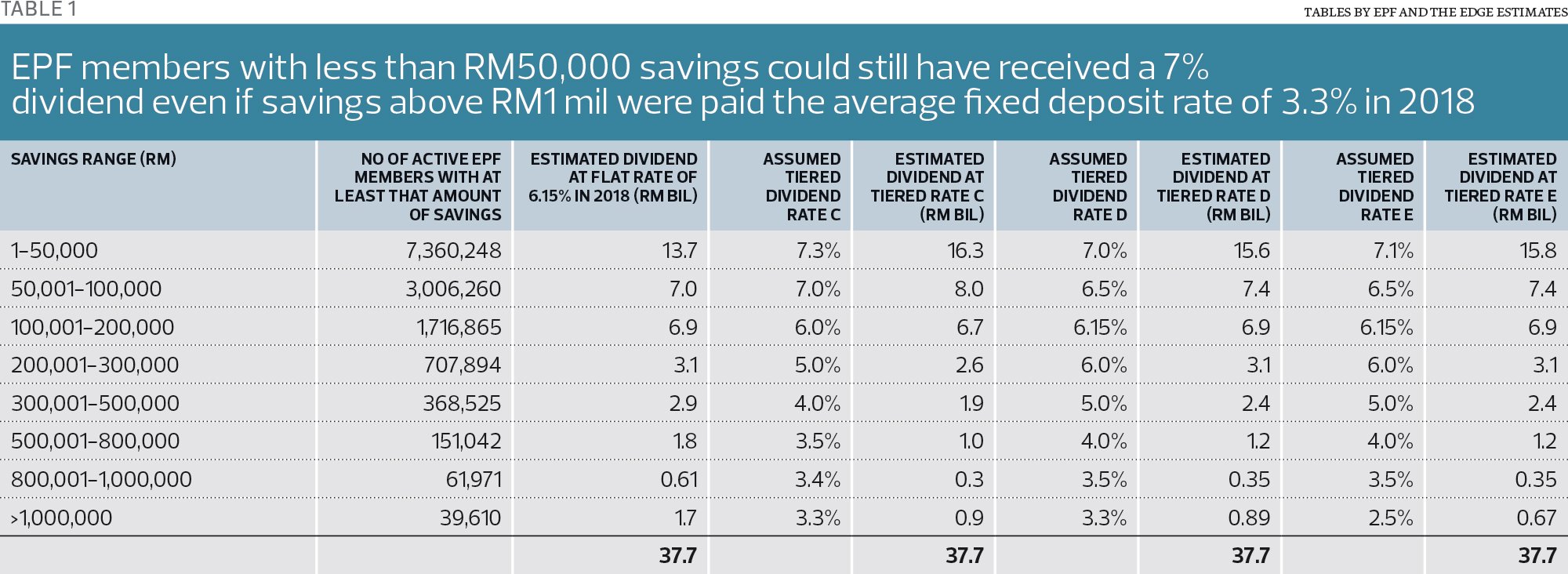

Ceo Epf Members Should Have A Say On Dividend Tiered Or Single Nestia

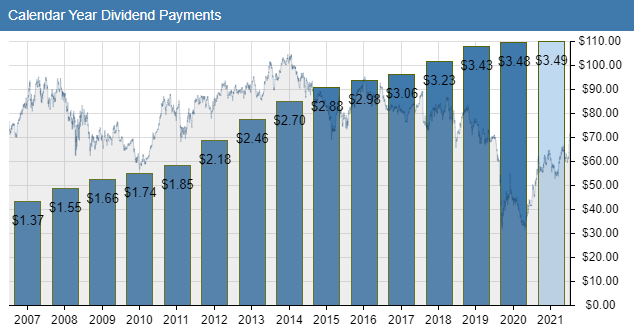

Seven Dividend Investments To Purchase For Profiting Despite 2022 Pitfalls Dividendinvestor Com

Highlighted The Various Break Even Points In Terms Of Deductions In Blue Therefore If Your Actual Deductions Are Greater Than Budgeting Personal Finance Tax

How To Maintain Your Unit Trust Investment Return Every Year Portfolio Management Bond Funds Financial Planner

Ratio Analysis The Payout Ratio

Chart Patterns Big W Chart Big Pattern

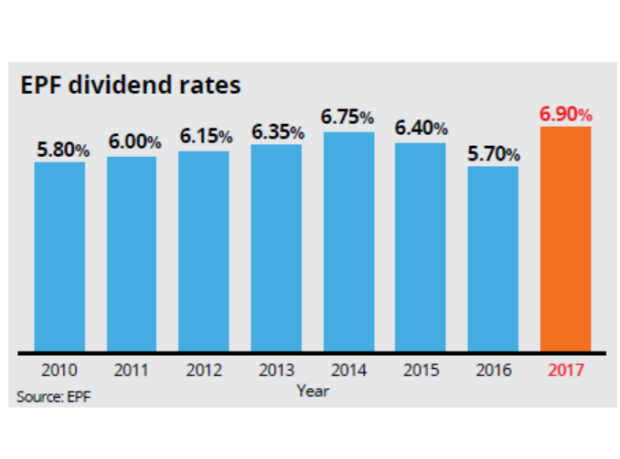

Highest Epf Dividend In Two Decades The Star

Financial Assets Savings Of The Households 2012 2018 Financial Asset Investment In India Investing

How To Maintain Your Unit Trust Investment Return Every Year Portfolio Management Bond Funds Financial Planner

Cboe Volatility Index Vix Volatility Index Brent Crude Oil Index

Invest Made Easy For Malaysian Only Historical Epf Annual Dividend Rate

Saprng 5218 Technical Analysis Technical Analysis Analysis Technical

How To Maintain Your Unit Trust Investment Return Every Year Portfolio Management Bond Funds Financial Planner

Evening 5 Epf Declares Dividend Of 6 10 For 2021 Video Dailymotion

Chart Patterns Big W Chart Big Pattern